Payroll | Management

System

Our Web services are delivered with many years of experience and We developing business.

What is a Payroll Management System?

Payroll Management System

A payroll management system is a tool - predominantly a software program - that enables your business to handle all your employee’s financial records in a hassle-free, automated fashion. This includes employee’s salaries, bonuses, deductions, net pay, and generation of pay-slips for a specific period.

Why do you need Payroll Management System?

Payroll Management System

As you would have just understood, your business activities are basically divided into two general categories: the macro and the micro.

The macro: refers to the large and big picture stuff. These are the activities that aid the long-term vision of your organisation. Your association improvement technique, income, deals. Income and so forth, associated with this classification.

The micro: refers to the the everyday activities of your business. Although these tasks seem mundane and repetitive, they are just as important to keep your business running like a very much oiled machine.

What Is In Store For You

Payroll Management System

- Integrated to HR Errands

- Employee Engagement | Database

- Deductions | Tax | Statutory Compliances

- Incentive | Bonus | Salary | Overtime

- What makes us unique of the crowd

- Payroll Linked Apps

- How Payroll Makes Life Easy

- Interface Payroll

- Contact Details

Subscribe to our updates

Sign up for our daily security updates, insider perspectives and in-depth security examination.

Integrated to HR Errands

ATTENDANCE

- Manual Attendance

- Automatic Attendance

- Semi-Auto Attendance

SHIFT

- Multiple Shift

- Flexible Shift

LEAVES & HOLIDAY

- Customized leave policies

- Leave carry forward, Leave approval

- Short Leave assignment

- Classify Holiday

Employee Engagement | Database

EMPLOYEE MASTER

- Official information/ Sleep Mode/ Employee personal

- E-documents

- Details of Salary

- Services

- Access & Roles authorization

SHIFTSELF-SERVICE

- Short Leave & Apply Leave

- Apply Executive duty

- Apply Expense Claims

- Verify/ Check Salary

KRA

- Produce Task

- Keep Team Members

- Track the task until finishing point

Incentive | Bonus | Salary | Overtime

SALARY

- Monthly Earnings

- Advance Earnings

- Earnings Approval

- Bonus Growth

- Pay slip Creation

OVERTIME

- Overtime Regulations/Criteria

- Overtime Result

- Overtime Agreement

INECNTIVE

- Incentive beside attendance

- Diverse incentive Regulations/ criteria

Deductions | Tax | Statutory Compliances

STATUTORY COMPLIANCES

- TDS

- ESI, EPF

- Advantage

- Chalans

DEDUCTIONS

- Uniform grant

- Employee safety fund

- Loan inference

- Advance inference

TDS

- TDS as per government norm

- Set TDS rate worker wise

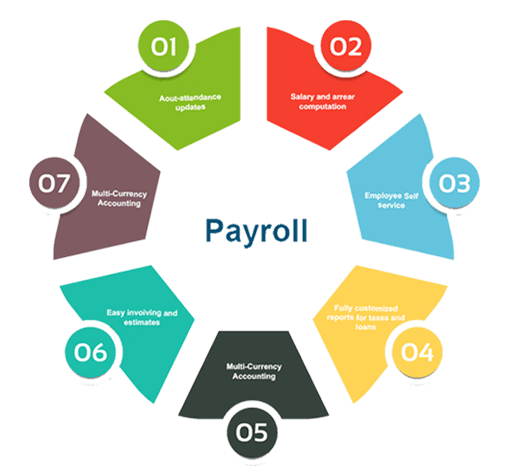

How Payroll Makes Life Easy

- Excel import to upload bulk data in one click.

- Single spot to handle multiple location data.

- Flexible Shift | Multiple shifts.

- 3 ways to upload attendance: Manual, Automatic, Semi-Auto

- Regular Attendance Upload

- Employee Self-Service

- Employee Sleep Skill

- KRA

- Short Leave

- Overtime calculation

- Incentive

- Loan Facility

- Payslip in English and Hindi

- Dashboard

Payroll – Linked Apps

Payroll Management System

TDS

Shows settings to set different TDS deduction criteria and automatic TDS application.

WEEK OFF ASSIGNMENT

Enables selecting and assigning desired week off day.

LOAN

Unlocks the tab for organized loan formalities and recovery.

SHORT LEAVE

Activates the option via which emps can apply for short leave.

ACCESS

CONTROL/AUTRORIZATION Authorizes primary user to limit access rights for sub-user.

LEAVE

Shows settings to enable the desired leave types.

KRA

Keeps task status updated to assure on time task completion.

ADD TEMPLATE

Setting essential HR document format to use frequently.

Our payroll processing team is responsible for welcoming new employees and ensuring their paperwork is correctly completed. Our company has been using the best payroll software with direct deposit for over three years. Our payroll management software offers an easy-to-use time tracking feature that keeps employees on track with their hours. Right payroll software can be a great asset for small business owners, giving them the ability to easily manage their full-service payroll needs. We use Quickbooks Payroll to manage our company's payroll taxes and employee benefits. Our payroll system has been deemed compliant with applicable tax regulations for the storage and handling of payroll data. We take pride in making sure that all of our employees receive fair and accurate employee wages, global payroll, tax compliance, and health insurance. Our payroll services and HR management system provide real-time insights and reporting, allowing businesses to make decisions quickly and confidently. Our payroll solutions provide comprehensive employee information to help streamline payroll processing.